Coin Alpha: April 2021 Outlook

Bitcoin and other digital assets have performed exceptionally well over the last three quarters. Institutional adoption, propelled by companies like MicroStrategy (MSTR), have profoundly changed the bitcoin-related discourse. MSTR currently owns 91 579 bitcoins (BTC), leading the publicly traded U.S. companies. MicroStrategy is followed by technology and automotive company Tesla (TSLA) that accumulated 48 000 bitcoins this year. In a bigger picture, Grayscale is the undisputed king among bitcoin-aligned institutions, holding 654 885 bitcoins.

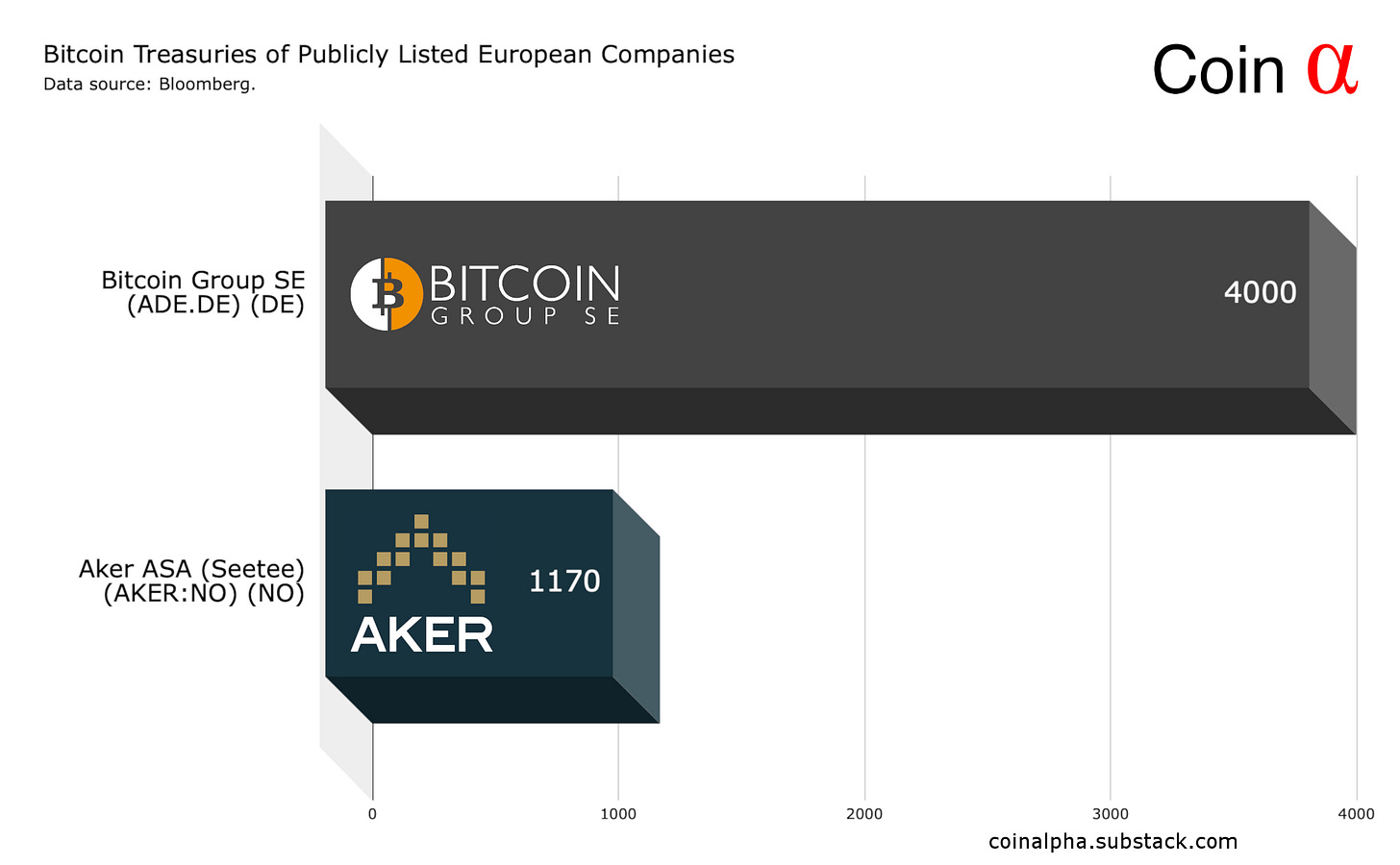

In addition to American institutions, Europe is gaining traction as well. In the last newsletter we took a deep dive into the fundamentals behind Norwegian Aker ASA and its subsidiary Seetee that currently owns 1170 bitcoins. German Bitcoin Group SE provides venture capital to companies with a focus on business concepts and technology. The Company operates Bitcoin Deutschland AG as a wholly owned subsidiary. Bitcoin Group SE currently owns 4000 bitcoins.

A Brewing Altcoin Season?

The definition of “altcoins” has varied over time, shifting along cryptocurrency narratives. The default description for an altcoin would be a cryptocurrency other than Bitcoin. Altcoins share characteristics with Bitcoin but entail divergent features. I’d personally classify most of the new “altcoins” as DeFi (decentralized finance) tokens, referring to their purpose.

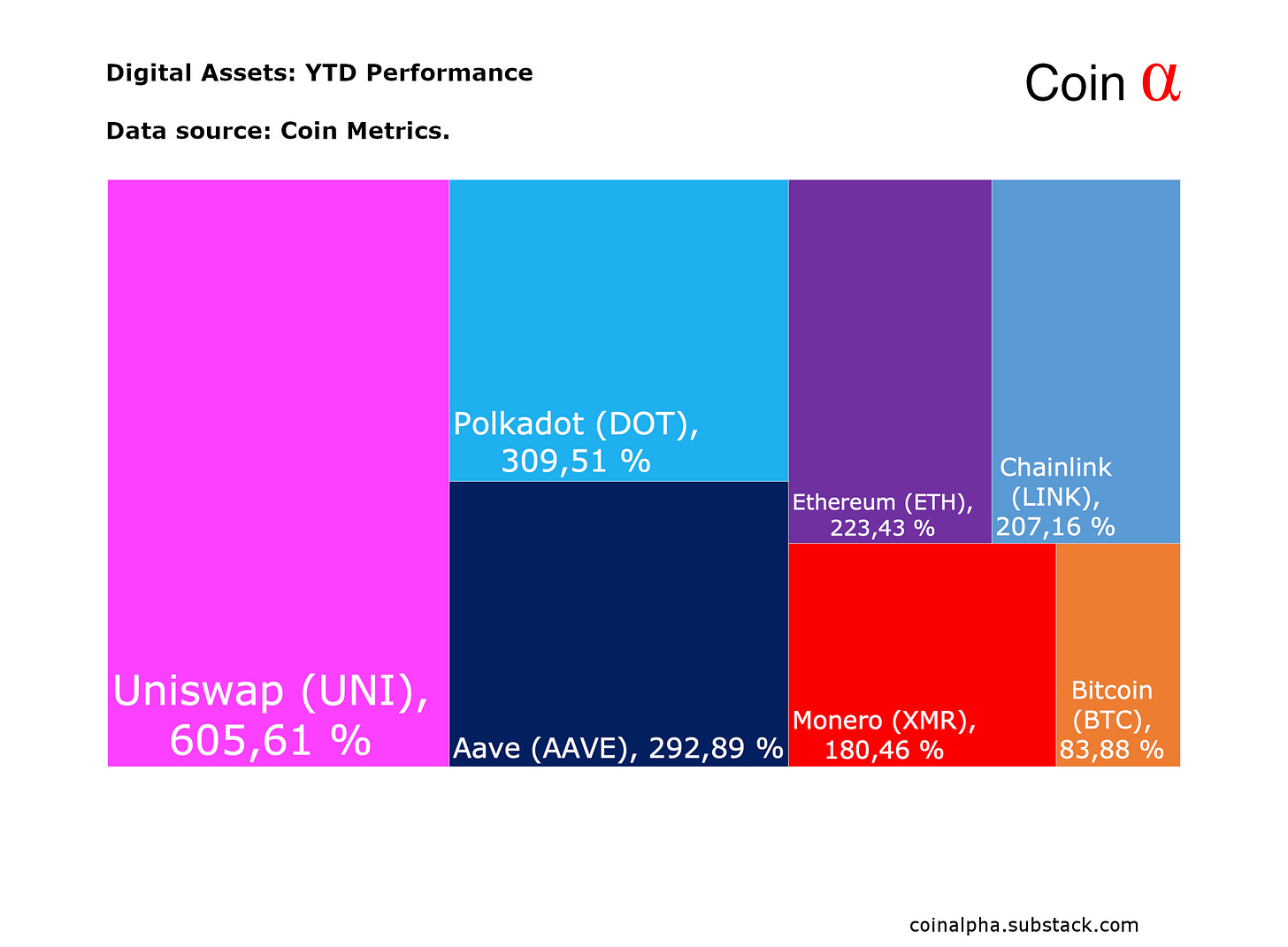

Looking at markets, a new trend is emerging as younger DeFi tokens like Uniswap (UNI), Polkadot (DOT), and Aave (AAVE) are clearly outperforming legacy assets year-to-date YTD. Uniswap’s price performance is totally in its own class, rising 605,61 percent since the turn of the year. Polkadot and Aave are following with around 300% growth for each during the same time horizon.

Altcoin season or “altseason” can be seen to have started when 75% of largest digital assets (by market cap) have outperformed bitcoin over last 90 days. This formula would indicate a clear and possibly secular altcoin season. Coins like DOGE and BNB have ascended 2361% and 1127,8% over past 90 days, mirroring the current sentiment.

Upcoming Bitcoin ETF

The Bitcoin ETF rumors are escalating again, with ever increasing amount of ETF applications. For the (possibly) upcoming ETF, here are the most relevant and sound candidates:

Founded in 2017, Bitwise launched the first cryptocurrency index fund and is the leading provider of rules-based exposure to digital assets. Bitwise recently filed plans for Bitwise Crypto Innovators ETF, which will track the Bitwise Crypto Innovators Index. That benchmark is constructed by Bitwise Index Services.

Fidelity, an American finance giant, is also planning to launch Bitcoin ETF, called Wise Origin Bitcoin Trust. The name Wise Origin is derived from the Japanese name of Bitcoin’s founder Satoshi Nakamoto: Satoshi (Wise) Nakamoto (Origin). The ETF would track the cryptocurrency through the Fidelity Bitcoin Index, which takes spot prices from various Bitcoin markets, including popular exchanges.

Grayscale manages the market-leading GBTC fund and holds over 654 885 bitcoins, the company has $45,1 billion in AUM. Grayscale’s recent plan is to convert GBTC fund into an ETF. The conversion would benefit Grayscale’s clients in form of lower management fees as the company currently charges an annual administration and safekeeping fee of 2 percent on GBTC. Grayscale’s other products charge even higher fees rising up to 2,5 and 3%.

Hypothesis: Ethereum, A Store of Value with Cash Flow

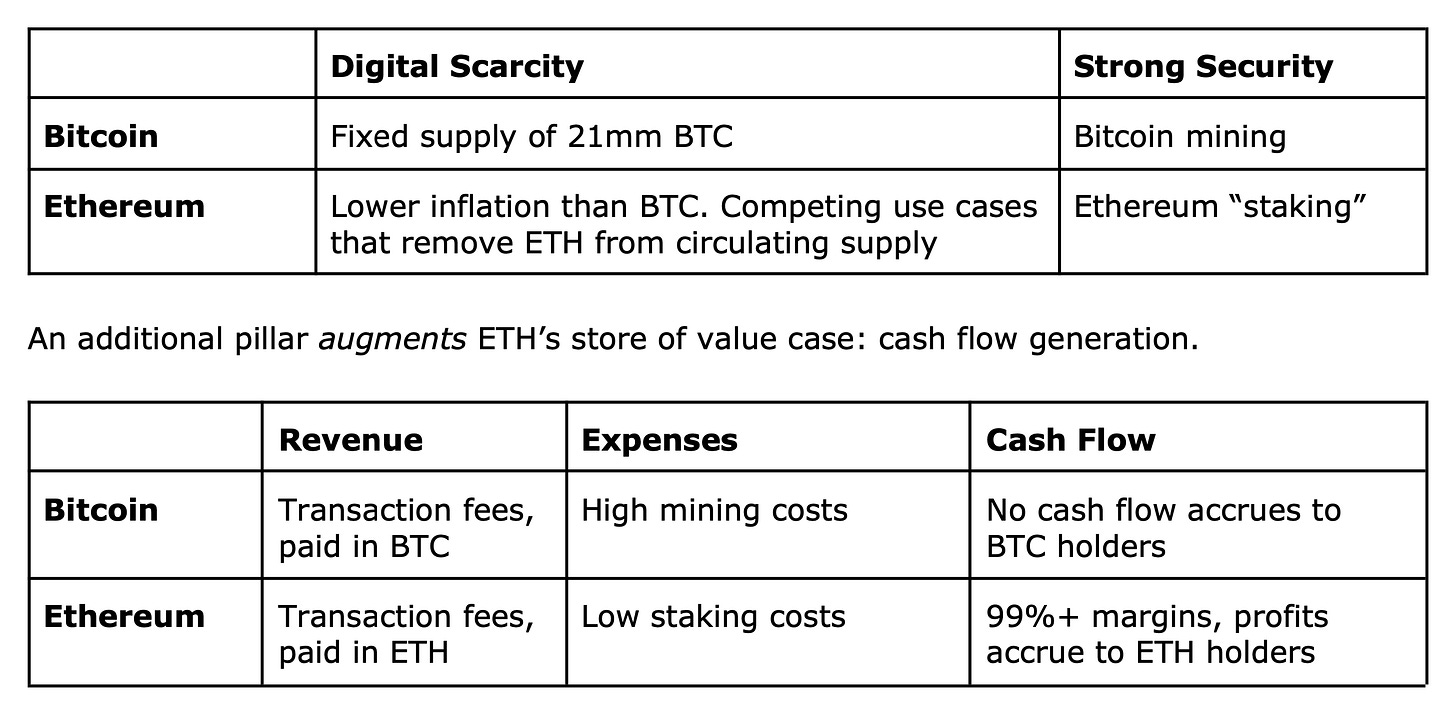

I recently found an interesting Ethereum-related report that takes a new approach into ETH’s future potential. The report named “Ethereum: A Store of Value with Cash Flow”, forecasts a $19,8 billion net income for Ethereum in 2022, all accruing to ETH holders. The report also includes a discounted cash flow valuation, conservatively suggesting a $16 770 value per each ETH token.

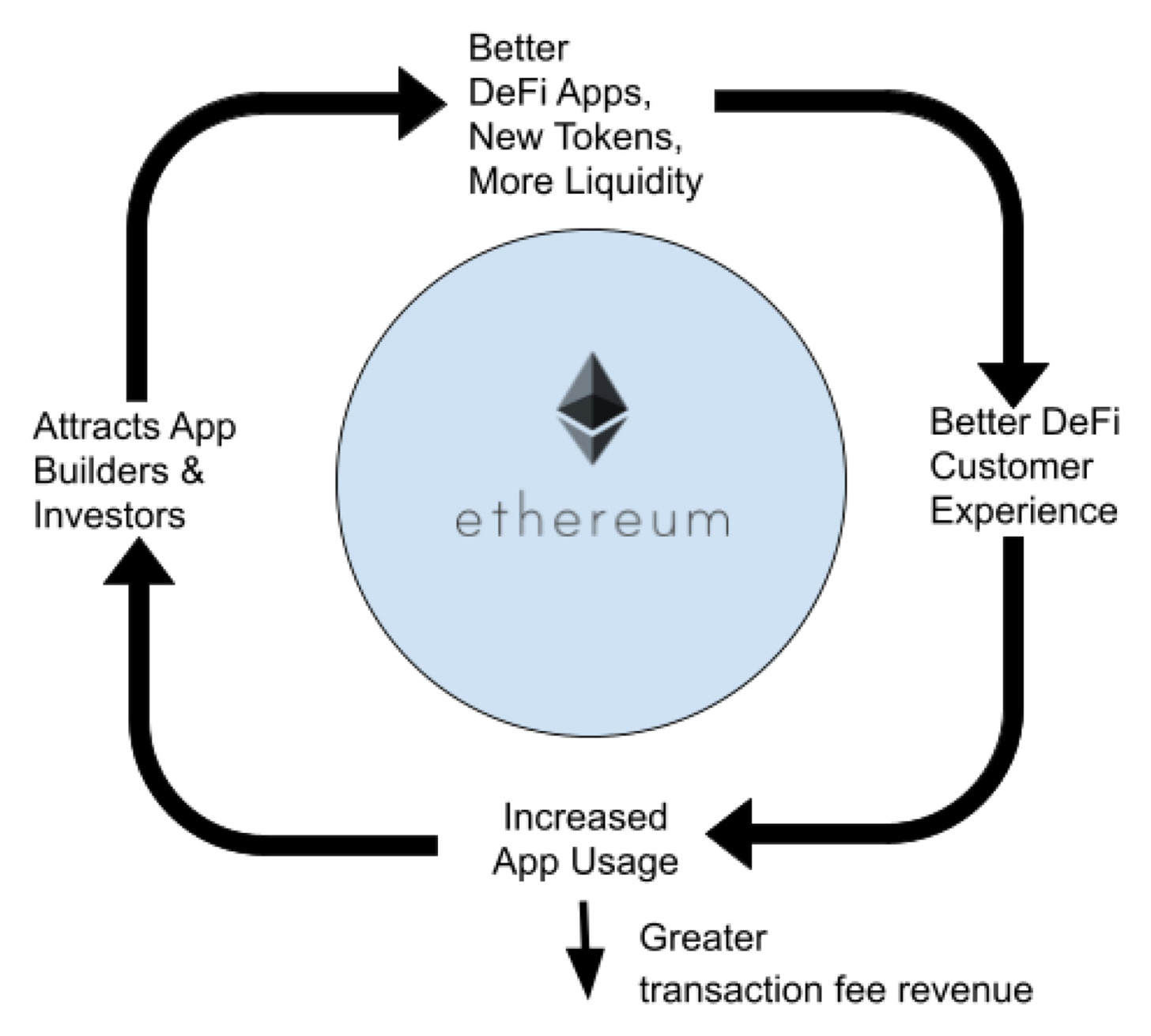

The report mentions multiple Ethereum advantages over Bitcoin: Lower inflation, competing use cases that reduce the amount of ETH in circulating supply, and low staking costs. The report sees Ethereum aligned with a virtuous cycle, where each developing tranche of Ethereum ecosystem supports the organic growth of others.

Coinmotion Lists Four New Digital Assets

Coinmotion, the leading Nordic digital asset exchange, has launched a new selection of assets including Aave, Chainlink, USD Coin, and Uniswap. You can explore the new asset introductions here.

Subscribe to Coin Alpha’s future updates here on Substack.

Editor: Timo Oinonen. LinkedIn. Twitter.

Disclosure: The information provided is for informational purposes only and is subject to change without notice. The information presented in Coin Alpha should not be construed as investment advice.